Anyone who works in the D.C. metro region knows the impact government contractors have on the local economy. But what many may not realize, is the impact these businesses have on the commercial real estate industry – with the top government contractors solidifying their footprint in the Metro area and activating submarkets that have been overlooked by other industries.

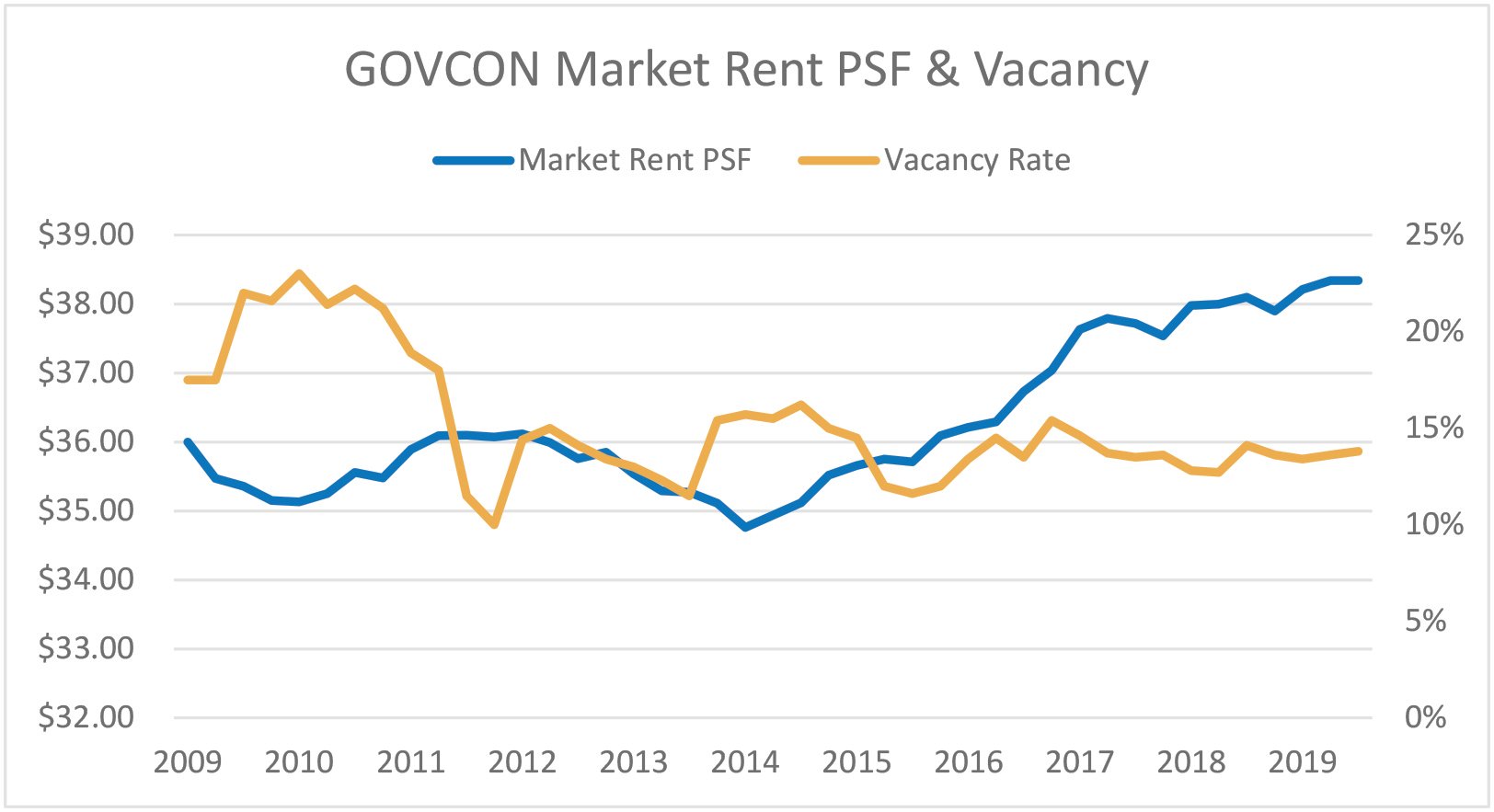

Analyzing a sample of the top 50 government contractors in the metro area, we noticed some interesting trends. Over the past 10 years, buildings occupied by these tenants have seen vacancy rates decrease by nearly 10-percent overall while rents in these buildings increased by nearly $5 per-square-foot, with some peaks and valleys along the way.

For example, Base Realignment and Closure (BRAC) drastically impacted these buildings between 2011 and 2014, when rents plunged and vacancy rates exhibited volatility. However, since 2016, our research indicates that rents have been increasing as vacancy rates have begun to stabilize, as shown by the graph below. Both graphs and this study feature a survey of buildings in the D.C. metropolitan area that are homes to the 50 largest government contractors in the area based on Metro-Area employees (source: Washington Business Journal 2019 Book of Lists).

This graph represents the historical vacancy and market rent performance of our 50-building survey.

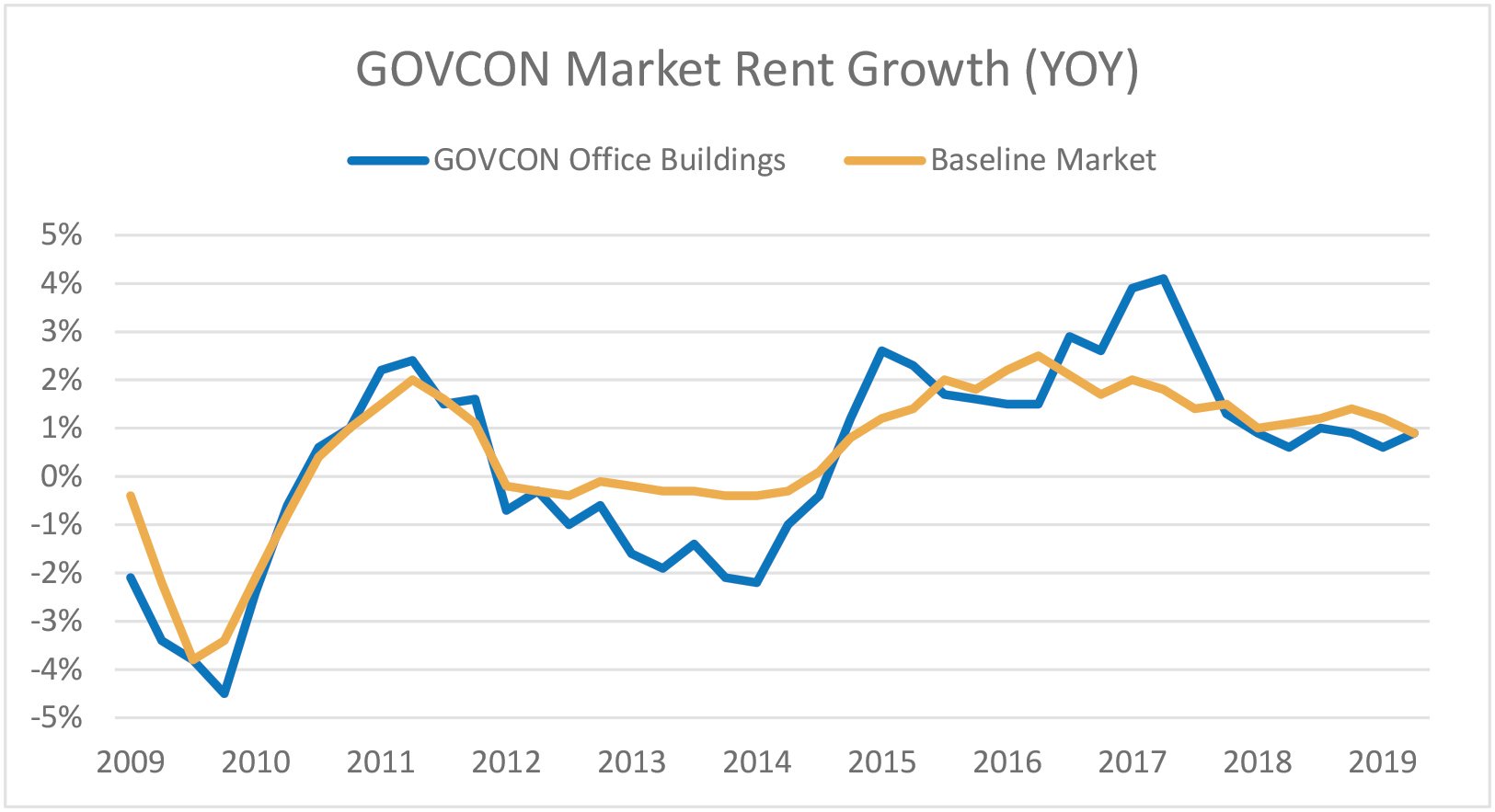

Because the government contracting industry is dependent on contracts with the federal government, our data shows that buildings occupied by contractors are more susceptible to volatility than the overall market, as shown by the rapid increases/decreases in market rent growth (below). The peaks are higher and the troughs are lower, with more uncertainty in regard to the year-to-year rent growth in these buildings.

One of the ways to combat industry volatility is a preference for space in less established, lower-rent markets. This allows them to accommodate for the sudden changes of the industry and keeps their bottom line secure. Contractors also aren’t just looking for office space. The need for flex/industrial components to accommodate research and development has also led them to these submarkets.

Dulles Corridor submarkets offer an abundance of different types of space that fits contractor need for scalability. It is not surprising that the Commonwealth has emerged as the dominant market in the region for these users. In fact, approximately 85-percent of government contractors are located in the Commonwealth, largely because of the inventory and diversity of space available in submarkets such as Reston, Herndon and Chantilly/Centreville.

This graph represents the market rent growth year over year of our survey and is compared to the entire D.C. office market’s performance over the same time period.

Govcon leasing is tied to contract activity, much of which can be speculative in nature. Flexible opportunities for growth, contraction and even termination of space will continue to be unique factors for govcon occupiers. Public policy can have a massive impact on commercial real estate, but particularly when it concerns govcon office users, and can vary from administration to administration. Currently the defense budget has never been larger than what it is today, with a current budget request over $700 billion.

Moving forward, Virginia will continue to be the dominant market for government contractors. On the heels of the Amazon HQ2 decision and with the influx of defense contractors and information technology firms, Virginia continues to emerge as a viable D.C. alternative. With help from the federal government’s robust defense budget, the defense contractor industry will continue to be one of the most viable in the region. Cybersecurity and IT-based tenants are also benefiting from this increase in contracts.

The D.C. region continues to be a great market for government contractors to hire and retain top talent. Proximity to the agencies is paramount, and in general, many owners of the office space/buildings leasing to government agencies are very bullish about the future.

National organizations like SIOR allow brokers the opportunity to make connections in regions where they have no experience, and establish contacts far easier than being on their own. Learn more at go.sior.com/results. This article originally appeared on Washington Business Journal online.

Matthew D. Levin is principal with West, Lane & Schlager, Washington, D.C., specializing in tenant representation, financial and market analysis, and long-term strategic planning. He holds the prestigious SIOR designation awarded by the Society of Industrial and Office Realtors. Only three-percent of U.S. commercial real estate professionals hold this designation. Chris Hanafin is the market research manager with West, Lane & Schlager, specializing in Washington, D.C. real estate market analysis.