The Players

Lenders: Willing to Drop the Puck

During the “Great Real Estate Recession,” loan fundamentals were a mess. Property values were not based on traditional property evaluation elements like rent-roll integrity, tenant creditworthiness, balance of property supply vs. demand, and appraisal integrity. Loan-to-value ratios were preposterous, as were exaggerated perceptions of future property value appreciation. These bedrock standards were ignored and coupled with a willingness to loan to anyone that could fog a mirror, as borrower underwriting was virtually non-existent. These were just some of the factors that froze the availability of debt capital.

Now, lending and underwriting standards are significantly improved. Equity vs. debt requirements is balanced, and borrower underwriting is significantly improved and demanding. Loan fundamentals are excellent. Capital is available and accelerating with a variety of debt structures increasing in a very competitive environment. To quality borrowers with skin in the game, money is not in short supply. Lenders are not holding up today’s game. They are, however, forced to raise interest rates and are increasingly concerned about recent and rapid inflation.

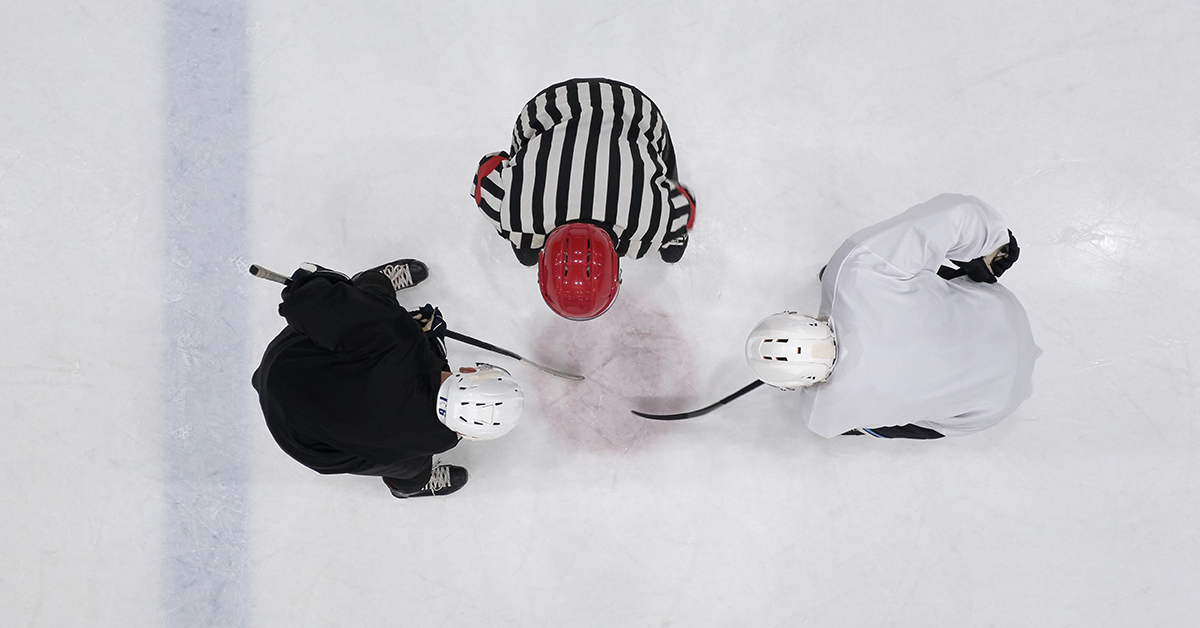

Lenders are standing in the faceoff circle…

Investors: Sitting on the Bench

These players are sporting huge contracts and are happy to re-start the game. The availability of capital—especially equity—is amplifying unabated. There is more cash in the market than at any time in history, and since many investors rely on availability of cheap debt capital, current deals are dying, are being repriced, and/or are taking a breather.

The cash and institutional investors have a distinct advantage as they are not dependent on expensive debt and the whims of the lenders. They are starting to skate in circles though, as they do not want to over-pay for their inventory.

Many investors are waiting to get in the game but on their own terms. They need Cap Rates to increase and properties to re-price in order to play. Their appetites are high, and they want to purchase more assets, but are stymied by the Bid Price vs. Ask Price gap, led by ever-increasing interest rates, and concerns that rent growth will be stymied by inflation. Many are sitting on the bench until after the mid-term elections and some are waiting for some good economic news.

Investors are skating on the too-warm ice of uncertainty…

Sellers: Banged-up by Unanticipated Injuries

Sellers—the multi-year Stanley Cup Playoff Champions—are not used to market obstacles impeding their quest for another Cup. They were enjoying record low and compressing Cap Rates driven by white-hot demand and a “full steam ahead” economy. Cash-laden buyers came from all sectors, including individuals, institutions, foreign buyers, 1031 exchange motivated purchasers, new-money, wealthy entrepreneurs, users, and investors. Almost every property sector and seller were in the game when suddenly, they are faced with adversity. Climbing interest rates, economic downturns, supply chain challenges, a shrinking buyer base, a flight to safety, and a pending fall election hampered their game.

Sellers want to play but are nursing their injuries…

Properties: The Best Teams Make the Finals

Industrial: Values have been holding or increasing in most sectors with industrial leading the way. Industrial property investment activity is now exhibiting a pause, and in some submarkets, cap rate compression is arresting. According to Logistics Management: “Amazon is now vetting subletting a minimum of 10 million square feet (MSF) worth of space.” and Wall Street Journal: “Amazon plans to sublet warehouse space to reduce excess capacity. The excess space will influence supply, but moreover may reflect more broad concerns expressed by Amazon—economic, industry, and market factors. These include high inflation, the war in Ukraine, and post-pandemic turbulence in e-commerce, digital advertising, electric vehicles, ride-hailing, and other segments. This is causing a ripple effect in the distribution marketplace, triggering some new developments to outright stop, other development plans to go on-hold, and many buyers to hit the brakes on further acquisitions.

Office: Those associated with office properties are discovering and pondering a period of reinvention as investors, landlords, brokers, tenants, and lenders navigate the battle between work from home and back to the office, while team hybrid-office is coupled with suburban vs. urban tensions stemming from concerns for public safety, occupancy costs, downsizing, right-sizing, and post-pandemic growth. In some cases, redevelopment and repurposing of existing office properties are adding to the on-ice chaos.

Properties that once were in favor may be facing trades…

Current Conditions

There are no real comparisons to the market conditions of a dozen years ago, but nevertheless, we are feeling a pause. The real estate fundamentals are much better, office and industrial markets have experienced unprecedented growth and value appreciation, and investor interest in CRE has increased exponentially.

In response to a thriving economy, industrial users have been expanding and consuming all classes of industrial properties in virtually every market. Quite suddenly, the economy swooned, and supply chains collapsed, which tripped up the best players on the ice: industrial properties.

The office market was severely and negatively affected by the lockdowns and fears resulting from the pandemic, which is now changing the course of how office space is consumed. Right on the heels of this setback, fear for employee safety is changing office user trends. The Office use paradigm is in flux, and its players are in the Penalty Box.

This time around, the teams are in the arena, and there is plenty of buzz, but we are between periods and must wait for the whistle to “Drop the puck...”

Houge originally write a similar article in 2010, for CIRE Magazine titled: Drop the Puck- What’s Holding up Commercial Real Estate Investment? that he has revisited here.