Avoiding risks when determining lease operating expenses during COVID times

Despite office buildings being open for business, they remain significantly unoccupied and under-used as tenants opt for the safety of working from home over congregating in the office with their co-workers. As a result, building services are being drastically under-utilized. Landlords need to be held accountable as to how they are calculating operating expenses so tenants are not left “holding the bag.”

It is important to note that this phenomena primarily affects office tenants that have signed, or plan on signing, a full service lease between the latter part of 2019 and the end of 2021 (or later).

Let’s start with the basics: What is a full service lease? It refers to a lease where the tenant pays a rent for the space as well as a fixed annual increase (to account for inflation and COLA—cost-of-living adjustment), and certain portions of annual increases in operating expenses for the building. One potential risk in a full service lease is how the increases in operating expenses are calculated throughout the term of the lease—which are often 10 years or longer.

In a typical year, a gross-up provision for operating expenses is incredibly important—particularly when establishing the base year. The operating costs in the base year is the metric used to determine the potential increases in operating costs in subsequent years for the entire duration of the lease. For example, if the tenant’s Base Year for operating expenses is $20.00 per square foot (the landlord’s cost to operate the building that year) and in year two of the lease, the operating expenses increase to $21.00 per square foot, then the tenant would be responsible for $1.00 times the tenant’s square footage leased. So in this example, if a tenant leases 10,000 square feet, they would owe $10,000. These are known as operating expense passthroughs.

A “gross up” provision ensures that the operating expenses are calculated as if the building were fully occupied. Otherwise, the base year calculation could be low if a building is not operating at full capacity leaving a tenant with exposure to higher passthrough costs going forward.

During COVID, most buildings have been mostly unoccupied, and expenses—such as utility costs—are much lower than during normal occupancy. Some landlords have estimated that these costs are down as much as 75%. While landlords are not supposed to eliminate services such as cleaning, security, staffing, etc., many of them are scaling services back to reduce costs. So what does this mean to the tenants?

If a tenant moved into a building this year and has a 2020 base year for operating expenses, it’s likely that the operating costs—and thus the base year—will be artificially low.

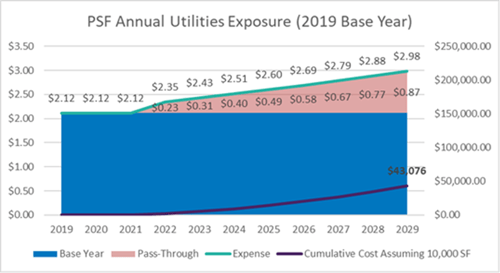

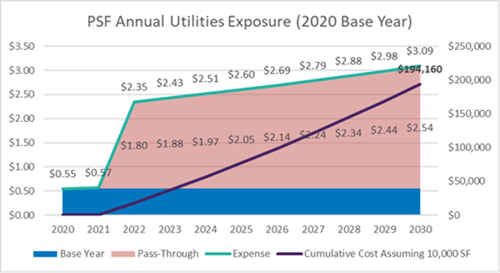

The example below illustrates a 75% decrease in only utilities (as compared to all costs that can be grossed up per a lease), and the financial impact this can have on the overall lease.

Assuming utilities are the only expense affected by usage, there is a 20% decrease in overall expenses, even with gross-up protections. In the examples above and assuming the tenant is 10,000 square feet, its exposure is ~$16,000 per year because the 2020 base year is artificially low. Alternatively, the tenant is exposed to an additional $16,000 in annual operating expense increases. This exposure occurs annual and will compound over the life of the lease. The issue is that once utilities are back to normal (as in 2019), this could be an incredibly significant cost exposure—in excess of hundreds of thousands of dollars over the lease term. Once a base year is established, there is no going back.

As tenant advisors, it is critical to think ahead and be in front of issues like these. Although many landlords will understand the issue and work with tenants to determine an equitable, resolution, it is unlikely they will bring this to a tenant’s attention, and it will be up to your advisors to flag this issue and work to resolve it. Passthroughs are not a profit center for landlords , and this is not a one time or short term issue. This situation could last well in to 2021 and 2022. Below are several recommendations on addressing a potential situation:

- Make sure the gross up language is drafted properly – address occupancy and full usage of services and expenses.

- Have protective audit rights in the lease document.

- Negotiate a Base Year Stop provision for operating expenses (an outdated concept but one that could be reinstated to resolve this issue).

- Eliminate a full service lease structure and adopt a net lease structure for operating expenses (eliminating the need for a base year calculation).

- Structure base years around the expenses of years prior to 2020—the average of the three highest years, or average of the three years prior to the effective base year.

The calculation of base years, operating expenses, gross up provisions, and COVID's effect on them, although very technical, significantly impacts the overall lease costs. If there is one thing we have learned about COVID and its impact, is that it can run deep. As advisors, it’s our job to think about them all—not just the basic issues. The above issues are technical and complicated and could absolutely have significant cost implications on our clients today and over the course of a long term lease.