Lately, there’s been a lot of talk about opportunity zones in the industrial and office real estate world. Let’s first dive into what exactly they are and how you can capitalize on them. Here are five things that every industrial and office real estate professional should know about opportunity zones:

- Opportunity Zone Definition

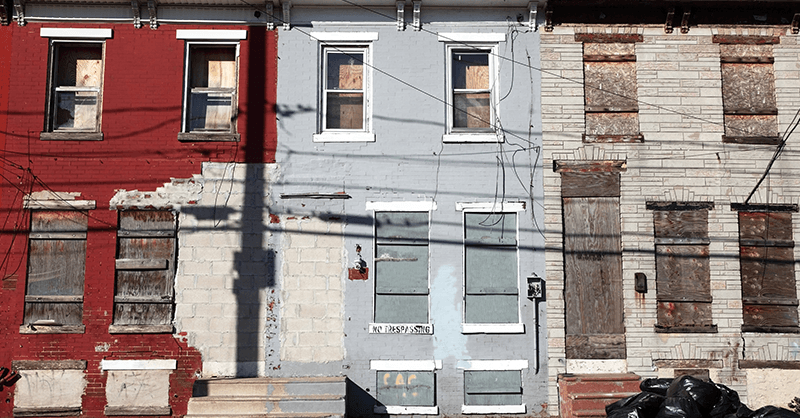

An opportunity zone is a designated area in low-income communities. These zones have been created to encourage economic revitalization across the nation. Therefore, new investments in opportunity zones can qualify for tax incentives if they maintain certain conditions. These conditions are outlined in detail within the Tax Cuts and Jobs Act of 2017.

- How Opportunity Zones Came to be

The Tax Cuts and Jobs Act of 2017 created the tax advantages that exist within opportunity zones. This effort was established to spur economic development in otherwise distressed communities. Opportunity zones are relatively new—in fact, the first set of opportunity zones were designated in April 2018. Now, over 8,700 certified opportunity zones span across the entire country.

Since this tax reform legislation has been in place, states nominate areas to qualify as established opportunity zones. After an opportunity zone has been nominated, the Secretary of the United States Treasury must certify the nomination through the IRS.

- Should You Invest in an Opportunity Zone?

Businesses of all sizes have the opportunity to take advantage of this tax reform. But, is investing in an opportunity zone the right decision for you? Many investors are drawn to the potential to contribute to growing economic hubs that ultimately benefit larger communities. In addition, investing in opportunity zones can result in great economic returns, including these tax advantages:

- If the investment remains until 2026, capital gains won’t be taxed until then.

- If the investment is sold prior to 2026, capital gains won’t be taxed.

- Gains from the investment will not be taxed if the fund has been held for ten years.

- Initial investments will have up to a 15 percent tax discount after seven years.

- How to Invest in Opportunity Zones

The process of investing in an opportunity zone is explained through various steps. To begin investing in opportunity zones, an eligible property must be found. Next, opportunity funds must be organized with the intent of investing in opportunity zones, holding at least 90 percent of assets in the zone. Finally, opportunity fund investments must follow guidelines established by the IRS and the Department of Treasury.

- Finding Opportunity Zones near You

If you’re interested in exploring or investing in opportunity zones, it’s quite simple to find an area near you. To begin your search, browse the comprehensive list of qualified opportunity zones, which can be found here.

Be sure to consider what opportunity zones could mean for you and your business. Also, check out the Winter 2018 edition of the SIOR Report for even more information on CRE opportunities that opportunity zones bring to the table.